Charged Off As Bad Debt Profit And Loss Write Off

If you have recently pulled your credit report and noticed a charge off you might be wondering how to remove the charge off from your credit report.

Charged off as bad debt profit and loss write off. What Does Charged Off as Bad Debt Mean. Charge-off What is a Charge-off. But that doesnt mean youre off the hook.

Change in jobs moving personal issues. They have never made an effort to pick the vehicle up. A profit and loss write off on credit bureau report is really just a fancy way of saying that the credit card company decided that a given debt wasnt worth collecting and took a write-off for it.

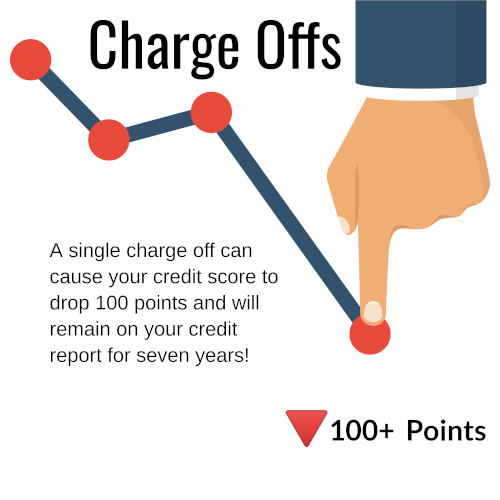

Bad debt reserves are shown on a companys balance sheet as a line item underneath account receivables the account it offsets or acts as a contra account to. Otherwise the charge off will stay on your credit report for seven years. Also known as a Profit and Loss Write-off a charge-off or chargeoff is the declaration by a creditor that a debt is unlikely to be collected.

Sometimes after trying to get payments and assessing your situation a lender might write off or charge off your balance as bad debt or a loss. I checked the credit report and it is Charged off as bad debt Profit and loss write-off. Its important to get charge offs removed.

Bad debt expense the companion to bad debt reserves shows on the profit and loss statement. A more important topic will be WHAT exactly was the last activity on this account. A charged off or written off debt is a debt that has become seriously delinquent and the lender has given up on being paid.

A charge-off is what happens when you fail to make your credit card payment for several monthsusually six months in a row. Charged-off debt is often passed between debt collection agencies resulting in multiple organizations contacting you for payment. Basically it means the company has given up hope that youll pay back the money you borrowed and considers the debt a loss on their profit-and-loss statement.